Rutuparna Rout • January 29, 2026

Top 10 accounts payable automation software in 2026: ratings & features

Last update: December 2, 2025

Managing accounts payable manually might seem simple when your business is new to the market, but as you expand, sticking to traditional methods can lead to delays, errors, and inefficiencies that prevent your business from growing. Accounts payable automation software offers a powerful solution, simplifying processes and enhancing accuracy. This blog talks about the importance of investing in an accounts payable solution, the various features a robust software has, a list of the best solutions in 2026’s procurement landscape, and how adopting the most advanced software is crucial for your business’s success. Read on to discover the key benefits and top solutions available today.

What is AP automation software?

Accounts payable automation software is a technology-driven solution that automates and simplifies the entire accounts payable process for businesses. It uses technology like AI and optical character recognition (OCR) to streamline tasks in the accounts payable process, such as invoice capture, data extraction, approvals, and payments. This touchless AP process eliminates manual intervention, boosting efficiency and ensuring on-time payments.

How does AP software work?

Accounts payable automation software digitizes the entire invoice-to-pay process through multiple digital steps, involving tasks such as capturing invoices, using OCR to extract data, and matching the information to purchase orders and receipts. Here’s a detailed explanation of the process.

1. Invoice capture with OCR and e-invoicing

This is the first stage of AP automation, which starts by digitizing incoming invoices using technology known as optical character recognition (OCR). OCR scans, reads, and decodes paper-based or printed text into machine-readable digital data. Additionally, this e-invoicing allows suppliers to submit invoices directly, requiring minimal to no human intervention.

2. Data extraction and AI integration

Once the invoices are embedded in digital form, AI and machine learning technologies extract important information and learn from past data. This enables the system to predict patterns, making processes more efficient and accurate. This allows even the most complex workflows to be initiated easily, with tasks like invoice coding or approval routing being done easily.

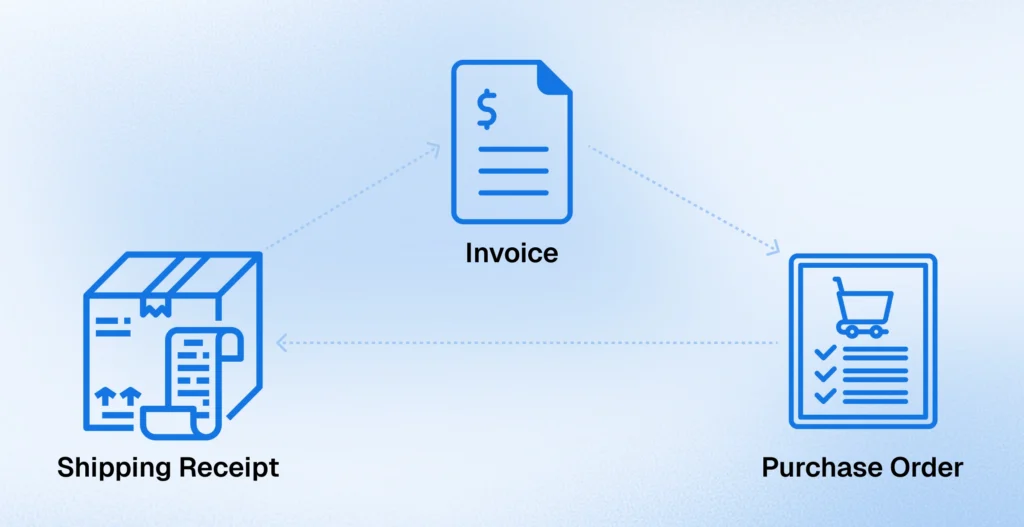

3. Invoice matching and verification

AP platforms then automatically match invoices with the respective purchase orders and receipts. This ensures that the invoices match the initially agreed-upon items, and only accurate and valid invoices are sent through the system for payment, reducing errors in the process and allowing the cycle to move faster.

4. Approval workflow automation

Invoices are intuitively routed to the right person for approval. This process is done accurately due to predefined rules set by the business, such as the invoice amount or department. This automation is intelligent as it removes the manual work but still allows the business to be in control of the steps and criteria of their approval workflows. Automated alerts and reminders are set to speed up approvals and ensure invoices are processed on time.

5. Payment execution and scheduling

Once the invoices are approved, accounts payable systems schedule and process payments. The software can optimize cash flow by selecting the preferred payment method and timing, which ensures on-time payments to vendors. In addition, organizations can also catch any available early payment discounts and maintain good relationships with vendors.

6. Reconciliation and reporting

After the payment has been executed, the system reconciles payments with corresponding bank statements to verify that the amounts align and everything is correct. Next, detailed reports are generated, which provide insights into spending patterns, vendor performance, and highlight opportunities for cost savings.

7. Supplier onboarding and self-service

AP systems often include supplier self-service portals for onboarding to make interactions between the supplier and the organization easier. Here, vendors can submit tax forms, update contact information, and track payment status. This way, suppliers are constantly in the loop with the accounts payable process and feel connected to the company at all times, improving vendor relationships.

8. Real-time spend visibility and analytics

AI analytics give companies real-time visibility into their processes, providing business intelligence that is useful to refine strategies and improve operations. This helps procurement teams make decisions with data. The best accounts payable software identifies patterns, tracks cash flow, and forecasts future spending, allowing better financial control.

Why should you invest in an accounts payable solution?

Consider investing in accounts payable automation software when you start to notice issues like high invoice processing, often over 100 per month, which is causing a heavy workload and draining your resources. It also might be the ideal time for a switch if you still rely on manual processes that cause delays, errors, and hinder visibility into your processes. Here are some reasons why this software is useful for you.

1. Manual work and invoice processing cause delays

Manual approval routing and invoice processing drain resources in no time. If your team is still struggling with repetitive logs, double entries, or uploading payments to the bank, consider switching to automation. Longer processing times mean higher burnout levels, slow payment cycles, and increased errors. Additionally, vendors expect payments on time, making automation necessary. AP approval software reduces repetitive work and helps teams remain focused on higher-value strategic initiatives.

2. High invoice volume and extended cycle times

As your invoices grow, so do vendor inquiries, which consume more time. Manually processing over 100 invoices per month, or more, in some cases, can strain your AP team. A study found that 40% of AP professionals spent six or more hours each month responding to queries, which interrupted workflows, caused delays, errors, and additional challenges in managing cash flow. AP invoice automation ensures high-volume payments are handled efficiently and accurately, even as the number of invoices increases.

3. Frequent payment errors

Having no mode of automation in place risks errors like duplicate payments, incorrect amounts, or missed invoices, and can disrupt operations and harm your supplier relationships. AP processing software bridges the gap between buyers and suppliers, automating tasks and ensuring payments are made correctly. Additionally, organizations report that automation can eliminate costly late payments and improve their control over invoices.

4. Lack of centralization

If your team is operating from different dashboards and using scattered data, it risks the formation of data silos and makes tracking invoice status, liabilities, and approval progress harder. This leads to delayed financial forecasting. However, centralized AP automation systems give organized reports and real-time insights. It was also discovered that companies using centralized platforms achieve up to 90% straight-through processing, reducing lost invoices.

5. Legacy system limitations

If your AP process is disconnected from your ERP or you still rely on Excel sheets to consolidate your data, you’re opening yourself up to a number of issues like inefficiencies, reporting challenges, and compliance risks. An integrated accounts payable solution scales effectively as your business grows, manages high volume, and remains compliant at every stage.

6. Scaling challenges with rapid growth

Rapid company growth can take teams and operations by surprise, overwhelming them and leading to unwanted errors like misplaced invoices, double payments, and delayed approvals. Teams struggle with growing demand, especially if they don’t have efficient systems to help them. AP automation systems help companies regain control. For example, Smyths Toys decreased approval times by 30% despite rapid expansion, keeping their invoice processing fast and accurate.

7. Global payment challenges

International expansion often involves complex and time-consuming tasks such as currency conversion and strict regulatory compliance, which need to be carried out with care and precision. Automated systems simplify these tasks, making cross-border payments easier and ensuring businesses remain agile.

8. Slow month-end close

Manual approvals, data entry, and reconciliation can delay month-end tasks like financial reporting and can affect cash flow. Automating approvals and invoice matching speeds up the finishing of these tasks, reduces bottlenecks, and keeps operations compliant. With accounts payable software for small business, even smaller companies have better insights into their liabilities and strengthen supplier relationships with AP systems, and can also handle higher volumes with ease.

What do experts say about AP solutions?

Accounts payable automation software is a helpful finance tool for numerous stakeholders in the procurement process. From finance leaders and ERP providers to suppliers, this software offers multiple benefits to the experts of the procurement industry, ensuring faster payments, fewer errors, and more reliability, making operations scalable and connected. Here’s why experts trust AP automation systems.

1. Finance teams: Gaining speed, accuracy, and control

Finance teams benefit greatly from AI-powered AP tools. They help eliminate manual data entry, reduce errors, and expedite the approval process. Offering integrations with accounting systems, AP systems take over the complex manual tasks and, in their place, give the team better visibility into cash flow and spending. A survey conducted by Stampli and Probolsky concluded that 89% of CFOs, VPs, and directors in the finance space were very interested in the usage of AI-driven accounts payable systems. Hence, with AP platforms, finance teams can make payments and handle budgets strategically without having to pick up a piece of paper.

2. ERPs and accounting platforms: Simplifying complex workflows

For ERP and accounting system providers, AP automation acts as a ready-to-use solution as it removes the burden of building or maintaining in-house invoice management tools. Fluiconnecto, a company specializing in the manufacturing of high-pressure hydraulics, used Medius’ AP integration for its ERP and saw a hike in invoice processing time by 50%. Therefore, these systems benefit from AP capabilities such as integration, which allows them to deliver fully-managed payment experiences that encourage efficiency and scalability for enterprise users.

3. Suppliers: Faster, more reliable payments

Suppliers reap among the biggest benefits of AP automation. Studies show that 46% of companies see an increase in vendor satisfaction after implementing automated AP technology. With these systems, suppliers have access to secure digital payment options, such as direct deposits or virtual cards, which enable them to receive payments faster. Additionally, automated reconciliation ensures that suppliers have full transparency into their payments, improving trust, satisfaction, and nurturing long-term business relationships.

10 best AP automation software for businesses in 2026

The best accounts payable automation software depends on your business’s needs, goals, and current systems. This accounts payable systems list highlights the top contenders in the market, with Procol leading the way, providing unmatched AI-powered AP solutions, Tipalti’s accounts payable software for large business for global, high-volume operations, Centime for its overall value and QuickBooks integration, and Stampli for hands-on, collaborative AP management. Here’s a list and detailed explanations of the best software in the procurement market today.

| Software | Best for | Pricing | Key features | Rating |

| Procol | Procurement teams seeking AI-powered solutions and intuitive automation. | Offers custom pricing models depending on business needs. | AI-powered invoice processing, supplier collaboration, customizable, multi-step workflows. | 4.8/5 |

| Tipalti | Large-scale enterprises with high transaction volume. | Starts from $99/month, plus custom pricing that includes its advanced features. | Global payments, tax compliance, PO matching, ERP integrations. | 4.7/5 |

| QuickBooks | Small to mid-sized businesses. | Starts from $19/month, plus customizable plans depending on the number of users and business size. | AP/AR automation, expense tracking, payroll integration. | 4.2/5 |

| SAP Concur | Large enterprises with complex needs. | Offers custom quotes based on business requirements. | Travel & expense management, invoice processing, and mobile app support. | 4.2/5 |

| Stampli | Companies requiring collaborative AP. | Offers custom quotes based on business requirements. | AI-driven invoice collaboration, real-time communication, and customizable approval workflows. | 4.5/5 |

| Centime | SMBs seeking integrated cash management. | Offers uniquely customizable plans based on the exact features businesses require, along with flexible add-ons for each plan. | AP/AR automation, cash flow forecasting, expense management, and banking solutions. | 4.6/5 |

| AvidXchange | Mid to large businesses with high invoice volumes. | Does not publicly disclose pricing and requires a custom quote based on an organization’s needs. | Invoice capture, approval workflows, payment processing, and supplier network. | 4.4/5 |

| Basware AP Automation | Enterprises needing scalable solutions. | Offers a scalable subscription model based on a company’s needs, and the Basware solution they choose (Standard or Premium). | Invoice automation, analytics, supplier portals, and compliance tools. | 4.7/5 |

| Coupa | Large enterprises with spend management needs. | Offers a custom subscription model depending on the module and the number of seats a business requires. | Procurement, invoicing, supplier collaboration, compliance, and AI-driven insights. | 4.6/5 |

| Airbase | Startups and mid-market companies. | Does not publicly list pricing, so customers must contact the organization for custom quotes. | AP automation, corporate cards, expense management, and real-time spend visibility. | 4.4/5 |

The above table showcases numerous kinds of AP systems, ranging from accounts payable software for small business to enterprise-grade automation. Selecting the right accounts payable software depends primarily on company size and specific needs, as the software should be a good fit and be able to scale as operations expand. It is also crucial for optimizing your finance processes in a simple and sustainable way. Procol stands out as the best AP automation software, offering intuitive integration and efficiency. Other top contenders like Tipalti and Stampli also provide powerful solutions for large businesses, ensuring streamlined accounts payable systems and better financial control.

What are the capabilities of accounts payable software?

Accounts payable automation software provides advanced capabilities that simplify and secure the entire source-to-pay process. The most important function of this software is automating the complete invoice-to-pay process, ensuring centralized collaboration, AI-powered efficiency, multi-entity support, and real-time insights. Here are the key capabilities of AP processing software.

1. Centralized collaboration and audit readiness

Modern AP solutions create a unified space where all information is centralized and teams can collaborate on various tasks, like invoice approvals. They can view necessary documentation from a single dashboard and track supplier communications effortlessly. Every note, update, and approval is tracked and stored in one place, so it’s easier to resolve issues and prepare for audits while ensuring visibility and compliance.

2. AI-powered efficiency and fraud detection

Accounts payable programs come with advanced AI that can recognize data patterns and alert teams of anomalies, which helps in the detection of suspicious payments in real time. These intelligent capabilities are making the software more desirable for growing businesses and ERPs alike, as they not only reduce human intervention and error but also enhance fraud prevention and compliance monitoring without adding to cycle times.

3. Multi-entity and global operations support

For businesses operating across multiple departments, subsidiaries, or countries, these systems are capable of multi-entity management. The AP invoice automation function allows finance teams to process invoices, manage approvals, and initiate approvals from a single platform.

4. Real-time reporting and control

Dashboards and live reports give procurement leaders access to all relevant information, such as cash flow, liabilities, and payment performance. Accounts payable platforms give timely insights and analytics, helping teams make the right decisions and identify opportunities to optimize faster.

What are the key features of accounts payable automation software?

Modern accounts payable automation software is equipped with multiple robust features to simplify the AP process, right from invoice capture to the last payment. These features include AI-powered invoice processing and capture, customizable and automated approval workflows with three-way matching, vendor self-service portals, reporting and analytics, and payment automation. Choosing the right solution helps finance teams process invoices faster and gain complete visibility into every transaction. Here are the key features of accounts payable systems for modern businesses.

1. Automated invoice capture and data extraction

What makes AP software stand out is its ability to accurately collect and process invoice details from emails, PDFs, or scanned documents using OCR and AI, often referred to as the touchless method. AP invoice automation significantly reduces the time spent on data entry and coding, helping small and large teams handle growing invoices efficiently.

2. Smart invoice processing and matching

Accounts payable automation software electronically matches invoices with purchase orders and receipts, which reduces the need for manual checks. This is a rule-based, three-way matching process that helps prevent duplicate or inaccurate payments by routing every invoice to the right approver. Additionally, if there is a discrepancy or a mismatch, the software alerts teams immediately so that the issue can be resolved immediately.

3. Customizable and intuitive workflows

Some AP software offers pre-built templates and workflows that allow for some customization, but larger, more advanced tools allow complete customization according to preset criteria. With accounts payable workflow automation, invoices go through a pre-defined approval process. With conditional routing, delegation rules, and multi-step approvals, managers can review and approve payments on time from anywhere.

4. ERP and accounting system integration

Accounts payable solutions should offer pre-built integrations with ERPs and other financial systems. Connections with systems like SAP, Oracle, Microsoft Dynamics, and more ensure all financial data gets pushed directly into your workflows. Procol, for example, offers multiple integrations with popular business names, eliminating data silos and keeping records accurate.

5. Custom rules and policy controls

Every company operates in accordance with approval hierarchies and payment policies. AP approval software allows finance teams to set custom rules for routing invoices based on the particular department, amount, or even vendor type. This enforces and ensures internal control, governance, and compliance.

6. Secure payment processing

AP processing software supports various payment methods, like ACH, wire transfers, and virtual credit cards, which enable faster and more secure digital payments. Many digital tools, like Procol, also offer a combination of both payment processing and spend tracking and management, which gives companies full visibility into their financial processes. Integrated systems are vital as they help reduce fraud risk and ensure compliance with company and industry standards.

7. Real-time visibility and analytics

Dashboards and visual reports provide real-time information on accounts payable processes, give teams a clear view of cash flow, and help identify areas where processes require more fine-tuning. These insights also contribute to monitoring team productivity and tracking pending payments. With past information and current reports, procurement leaders can forecast better and make quicker decisions.

8. Role-based access and audit trails

Audit-ready logs help maintain compliance. With cyberfrauds and threats being common in the digital space, it’s important to have a secure system in place. The best accounts payable software also helps in tracking every invoice change, approval, and payment. Additionally, implementing a role-based workflow ensures that only authorized users can view or edit sensitive information.

9. Scalability for growing businesses

AP automation systems adapt to the needs of organizations as they grow, even if they expand from processing fifty invoices to hundreds of thousands. So, even if you start small, with seemingly less advanced software, just know that the best accounts payable software for small business will scale with you and meet your growing requirements. That’s why it’s so critical for growing teams to use accounts payable automation software: it ensures accuracy and speed for those handling high transaction volumes.

10. Vendor and supplier self-service portals

Encouraging vendors to complete certain tasks independently relieves the load from your AP team. Some accounts payable automation companies offer self-service supplier portals that give them visibility into payments, invoice submissions, and more, so that there’s less confusion and inquiries required. Vendors can check their payment status, raise queries, and upload documents, reducing back and forth and improving transparency.

11. Integration with accounts receivable software

Many modern tools also integrate with accounts receivable software, which helps create a centralized financial system, giving teams and vendors a complete view of all activities done in the AP process. Accounts receivable management software provides a unified ecosystem that ensures alignment and cash flow management, simplifying reconciliations and improving overall financial control.

12. Mobile access and remote collaboration

With hybrid models becoming more popular day by day, finance teams need flexibility. Mobile-intuitive AP automation for small business enables remote invoice approvals, sends real-time notifications, and allows teams to process invoices from any device without interrupting their communication or productivity.

What are the benefits of accounts payable software?

Accounts payable automation software offers multiple benefits for businesses, such as reduced costs, improved accuracy, enhanced efficiency, and better cash flow visibility and management. From introducing automation and reducing manual labour, AP software helps companies transform their financial processes. Here are the key benefits of this software.

1. Streamlined AP workflows for efficiency & time savings

Automating your accounts payable workflow eliminates time-consuming manual tasks like data entry, payments, and invoice approvals, which helps accelerate productivity. Accounts payable workflow automation speeds up payment cycles and reduces manual errors, so your team can give strategic enhancements their undivided attention.

2. Significant cost savings across the invoice-to-pay process

AP automation helps in dramatically reducing costs. Manual processes like data entry and storage are often expensive and require more manpower. Not to mention, increased usage of paper, postage, and labour. With automation, businesses can save significantly. Additionally, companies report up to 80% savings in processing costs when switching to AP processing software.

3. Faster invoice approval

AP approval software ensures invoices are processed on time with automated routing, validation, and approvals. Automatically approved invoices shorten the lifecycle from days to hours and ensure all tasks get completed within the scheduled time, allowing timely payments and preventing late fees.

4. Improved accuracy with automated invoice matching

AP automation tools help eliminate human error by matching invoices with purchase orders and receipts, validating data against ERP systems, so all discrepancies are flagged before payments are made. Duplicate payments disappear from the software, preventing wasted funds and avoiding confusion with vendors, ultimately enhancing data consistency.

5. Fraud prevention with tight security controls

The best AP automation software helps prevent fraud-induced expenses and saves billions annually. Fraud detection and monitoring notify teams of duplicate invoices, flag suspicious vendor activity, ensure secure payment approvals, and provide audit trails. Additionally, it restricts system access with user roles and permissions, which help prevent both internal and external fraud.

6. Enhanced visibility with real-time data insights

With the best accounts payable systems, finance teams gain real-time visibility into all financial aspects. Dashboards provide comprehensive insights into invoice statuses, payment approvals, and cash flow. Historical data also makes it easier to forecast and conduct audits. Reporting tools give decision-makers control and help them track procurement KPIs, identify disruptions, and make correct decisions.

7. Improved vendor relationships with on-time payments

Timely payments and better communication through automated systems help in strengthening and maintaining vendor partnerships. With consistent payments, you build trust, credibility, and transparency in your relationships, ensuring all interactions remain pleasant and professional. Automated systems help teams communicate faster with suppliers and avoid disputes. Tracking invoice status in real-time helps ensure that your suppliers are always paid promptly, promoting long-term loyalty.

8. Early payment discounts with automation

AP automation makes it easier to capture early-payment discounts by ensuring invoices are approved and paid on time. Payment discount optimization helps businesses spot these opportunities provided by vendors and take advantage of cost-saving opportunities that would be missed with manual processes.

9. Scalability to grow with your business

As your business grows, AP automation ensures your finance operations are well-equipped to handle the volume of invoices without posing a challenge. Unlike manual processes, which are unable to keep up with expanding processes, automation scales easily and adjusts to all situations, handling workload efficiently and without increasing headcount.

10. Easy integration with existing financial systems

The best accounts payable software connects effortlessly with your ERP and other financial systems, such as accounts receivable management software, and doesn’t cause glitches or technical issues. A seamless integration means a unified system with consolidated information that the whole team has access to, less dependence on IT, smoother workflows, and accurate forecasting. It also eliminates the need to re-enter data across multiple platforms.

11. Simplified compliance with built-in audits and reports

AP automation provides robust tracking and reporting capabilities like audit trails, which make it easier to maintain regulatory compliance. Built-in reporting and version control help simplify external reviews, and centralized document storage makes retrieval seamless and accessible for concerned persons. Accounts payable automation software streamlines financial documentation for quarterly and annual filings.

12. Optimized cash flow management

With greater visibility into pending payments, businesses can optimize their cash flow by making informed decisions instead of reactive, unplanned ones, making cash flow more strategic and goal-oriented. It also allows wise decisions about payment timing. Additionally, accounts payable workflow automation helps in cash preservation while also helping businesses recognize and take advantage of early payment discounts.

How Procol’s accounts payable solution helps in the procurement process

Every finance team knows the dreaded feeling of invoices piling up, approvals stuck in email threads, and a month-end close that barely makes the cut. Procol was created to change that.

Unlike standalone accounts payable automation software, our software connects your sourcing, invoicing, and payments in one flow, so your team doesn’t struggle with complex and disjointed systems. Our solution is better than simple AP software; it’s the modern way to run procurement.

With AI-powered automation, Procol simplifies and speeds up invoice matching, routing, and reconciliation, so your team can process payments faster and with fewer errors. Additionally, one of our clients cut approval times by 60% in the first month, which is strong proof that automation can truly make a difference without adding more manpower.

Procol.io approaches procurement in a unique and intuitive way, surpassing the generic and traditional AP automation software by uniting procurement and payments in one intelligent workflow. It automates invoice approvals, matches POs instantly, and gives teams real-time spend visibility. Our platform helps businesses simplify cash flow and strengthen control in one click, without adding extra tools or complexity.

See how Procol’s best AP automation software experience can bring clarity, control, and confidence to your procurement journey.

Conclusion

This blog has explored how accounts payable automation software can transform your finance operations, right from reducing errors at the base level to speeding up once time-consuming approval workflows. It’s important to choose a system that fits your needs the best. Whether you’re tackling high invoice volumes, scaling operations for the future, or managing payments globally, you’ll know the solution is right for you when you start seeing real results. Tools like Procol are leading the way in helping businesses make this change today, ensuring timely payments and giving them visibility into their financial activities. By implementing these solutions, companies can enhance cash flow management and improve supplier relationships, making more partnership-friendly and strategic decisions.

Schedule a Demo

We’d love to hear from you. Please give us a call on +1 315-645-2799.

Explore more from Procol

Discover expert tips, how-to guides, industry insights, and the latest procurement trends.

Procurement orchestration: All you need to know in 2026

Explore the value of procurement orchestration, how it works, its benefits,...

Top 22 spend management KPIs to optimize procurement in 2026

Today’s business world has moved from just ‘buying’ to ‘managing spend’...

What is supplier diversity and why is it important?

In the modern corporate competitive world, where both market resilience and...